As the popularity of renewable energy explodes across the world, researchers have turned their minds to methods allowing electricity generated by household-based energy systems such as solar panels to be purchased and sold in a manner similar to shares on the stock market.

Scientists from the University of Wollongong have created a new prototype computational algorithm that allows individual batteries within virtual power plants to instantly charge and discharge, maximising the revenue gained from buying and selling electricity as prices shift.

Whereas electricity was previously generated by brick-and-mortar power plants, renewables have altered the landscape by fragmenting energy production and storage. Instead of a centralised power source, batteries and solar panels located in individual households can be grouped together in a sort of network, called a virtual power plant, with firms such as Synergy and AGL already offering their own VPP services.

Using, sharing, buying, selling

Chixin Xiao of the University of Wollongong’s School of Electrical, Computer and Telecommunications Engineering has combined computer science and energy engineering to create a better way of buying and selling power in these new VPPs.

As lead author of a soon-to-be-published paper1, Xiao developed a theoretical real-time management strategy for VPPs that improves on more traditional methods which stumble due to the complexity of predicting and responding to energy price changes in these newer VPP systems.

“Because household solar power systems have become popular, we no longer only receive energy from the power grid but can also share our remaining energy with the grid. Thus the electricity stream has been changed from a conventional one-way direction. That means you can sometimes act as a user of electricity but if you have energy to spare, you have the opportunity to share that energy with the grid,” Xiao told Lab Down Under.

Through Xiao’s multi-period data driven control strategy, users can choose the rate at which batteries in a VPP charge or discharge — effectively buying and selling electricity — as energy prices fluctuate over time.

“Assume you are buying and selling stock on the stock market and you want to maximise your total profit over a period of time. That’s a representative stochastic optimisation problem. Likewise in a VPP, each battery needs to charge or discharge according to the instant electricity price prediction in order to maximise your profit,” Xiao said.

A three-layered prototype

Xiao’s strategy works by creating a finite-state machine, which is a sub-class of Turing machine, out of the VPP. A Turing machine is a mathematical model created by English mathematician Alan Turing, describing an abstract machine moving along a tape and modifying the 1’s and 0’s it sees. This machine, Turing hypothesised, could be used to run any sort of algorithm. It is currently the gold standard in computer science with programs graded based on their ability to function like a Turing machine.

The newly developed method uses a novel programming language and special grammar to manage the real-time control of battery storage. Each battery in a VPP thus acts as an energy generator, storage unit, buyer, seller or sits in an idle state.

The model itself contains three layers: the hardware layer consisting of the batteries themselves, the software layer through which the user communicates with the VPP, and an intermediate layer translating the computer language used by the two other layers.

“Following this three-layer prototype, it’s very easy to organise the traditional power grid and transform it into a new structure like a computer,” Xiao said.

While the prototype is not ready to be used in VPPs as yet, because both the battery hardware and the compiler language have to be further adapted, the model shows promise as a better alternative to current VPP systems which use clunky stochastic optimisation methods that have to be completely updated when price predictions change.

“Following conventional methods, you need a day-ahead schedule. When you met uncertainty conditions, you need to update that schedule and the entire scenario tree. It is not suitable for real-time control,” Xiao said.

“But with this three-layer prototype, you’re just focusing on updates with price predictions. You don’t need to change the hardware actions because at the compiler level, that work has already been done.”

From continuous to discrete

Xiao’s system takes the typical battery’s ability to charge and discharge in any amount between zero and its maximum energy capacity, and simplifies this by breaking down this range of actions into discrete chunks. In this way each battery will draw in and send out energy at certain levels depending on energy price predictions.

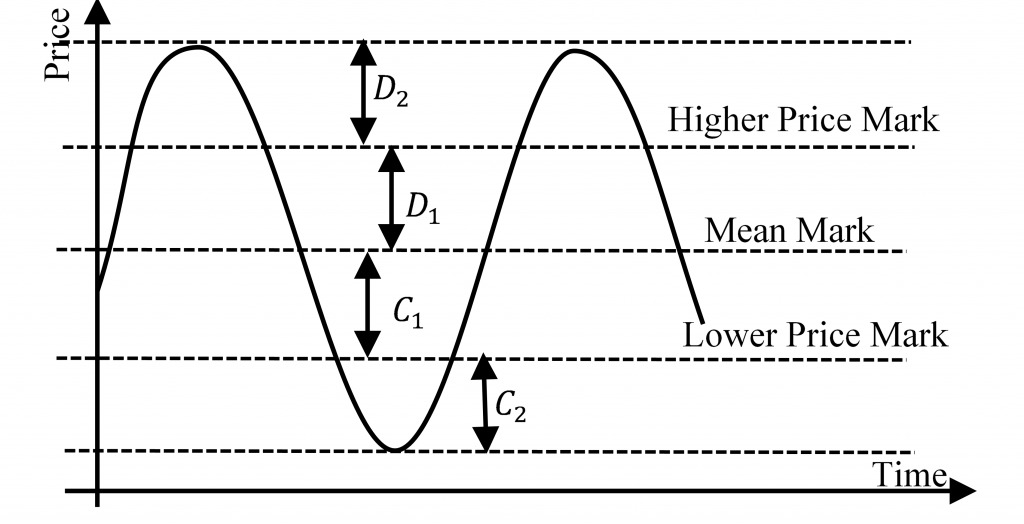

Figure 1: Predicted Price Curve in 4 levels

“You can divide the price range into four levels: C1, C2, D1 and D2. For D2, the price is good and you should discharge your energy at a faster rate. For D1, discharge at the normal rate because the profit is good but not good enough. In the same way for C1, you can buy energy slowly because it’s cheap. For C2, it’s then very cheap so you buy at a faster rate,” Xiao said.

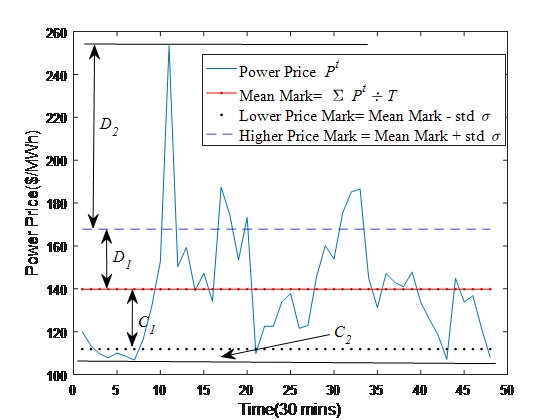

Breaking the graph down into four layers is simply a very basic example with future versions able to divide the range up into even more regions with diverse charge and discharge rates depending on the model, Xiao told Lab Down Under. The actual changes in energy prices will also fluctuate more erratically over time as demonstrated by the figure below.

Figure 2: 24-hour price data sampling per 30 mins

Xiao’s prototype also includes a safety rate for when a battery is close to being completely full or empty. In this state, the battery can thus only discharge or charge until it reaches safe levels and can then participate in energy market trading again.

While the simulated model shows promise as a method for real-time battery control, Xiao said that further work would be required to enhance the energy efficiency, operational flexibility and economic revenue within the grid environment in order for the prototype to be used practically.

Author’s note: If you enjoyed this article, you can follow Lab Down Under on Facebook or support me on Patreon. I also have my own personal Twitter account where I’ll be sharing my latest stories and any other items of interest. Finally, you can subscribe here to get my weekly blogs in your inbox.

1 Multi-period data driven control strategy for real-time management of energy storages in virtual power plants integrated with power grid, International Journal of Electrical Power & Energy Systems, Volume 118, June 2020

Featured image: Solar Panels on a Roof. Image by Pujanak.

Would this cause increased wear, and reduced lifespan of the supercapacitors?

That’s a good question, but unfortunately it’s one I can’t answer because I don’t know. The model here is theoretical at the moment so it’s possible more testing will be needed to determine that? I’ll reach out to the researcher and see if he knows.

The proposed strategy does not require to update much on the hardware associated with the battery energy storage system (BESS) in the power grid.

The major concern of the proposed research is on implementing real-time control by transferring the corresponding continuous controls such as charging or discharging into discrete ones.

In the conventional controls of BESS in power grid, the charging or discharging amount each time is a variable in a continuous domain, considering uncertainty, which may consequently lead to a possible scenario-space to be intractable over a time-span.

Therefore, the discrete weight (or basis) is adopted to formulate all possible control actions of BESS into several finite states.

Such kind of design guarantees each battery unit has only finite actions and, hence, simpler software driver, which is effective to respond in time in an uncertainty environment.

The inspiration originates from the computational theory in computer science, and more details can be found in our future works. If you are interested in talking about it further, please feel free to let me know.